“The only thing we have to fear is fear itself.” - Franklin D. Roosevelt

We hope our note finds you and your family doing well. We are reaching out to give you an update on our most recent rebalance and discuss some of the trends we see.

We have had a great two-year run in the markets. However, at this point we have given up our early of the year gains and are now seeing more volatility.

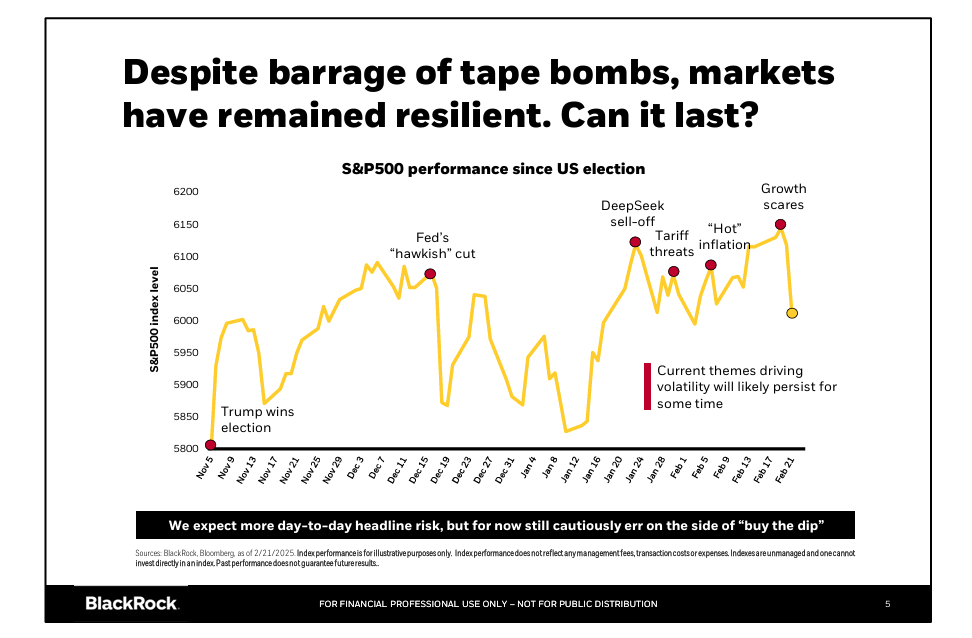

We moved into 2025 with a decidedly risk-on stance in our portfolios, reflecting an optimistic view of the strength of the overall U.S. economy and a better-than-consensus outlook on the trajectory of corporate earnings. But over the past few months, the markets have been on quite a rollercoaster ride driven by a series of headline-grabbing events. Following the election, there was a surge in market returns as investors welcomed a pro-business agenda, with potential for corporate tax cuts and deregulation. However, this initial excitement has begun to wane.

Blackrock put together this chart showing the markets since the election:

Our recent rebalancing

As a team, we are very focused on the health of the economy, as well as consumer and corporate fundamentals. We focus on these fundaments and ignore the daily barrage of chaotic news that may or may not be based on facts. The U.S economy appears to be strong on many measures, including corporate earnings, unemployment, and consumer spending.

However, there is an uptick in market volatility in response to inflammatory headlines, that underpins our decision to make a slight trim to our risk levels while maintaining a strategic overweight to risk assets. It is normal for markets to have short-term pullbacks and volatility, even in a strong economy.

Here is what we are doing:

We are trimming our overweight to equities from a 4% overweight to a 3% overweight. We maintain a clear preference for stocks over bonds while adjusting the complexion of our risk-on stance.

We are increasing our overweight to U.S. over international developed market stocks. We are favoring large, high-quality U.S. companies with relative earnings strength.

In November we added a small 1% position to gold, which is up 10% since we put it into the model. We are going to increase this position to 2% of the portfolio. We like this alternative asset and believe it acts as a counterweight for global trade issues and geopolitical conflict.

Within our fixed income sleave, we are shorting our duration within our U.S. treasuries.

Tariffs

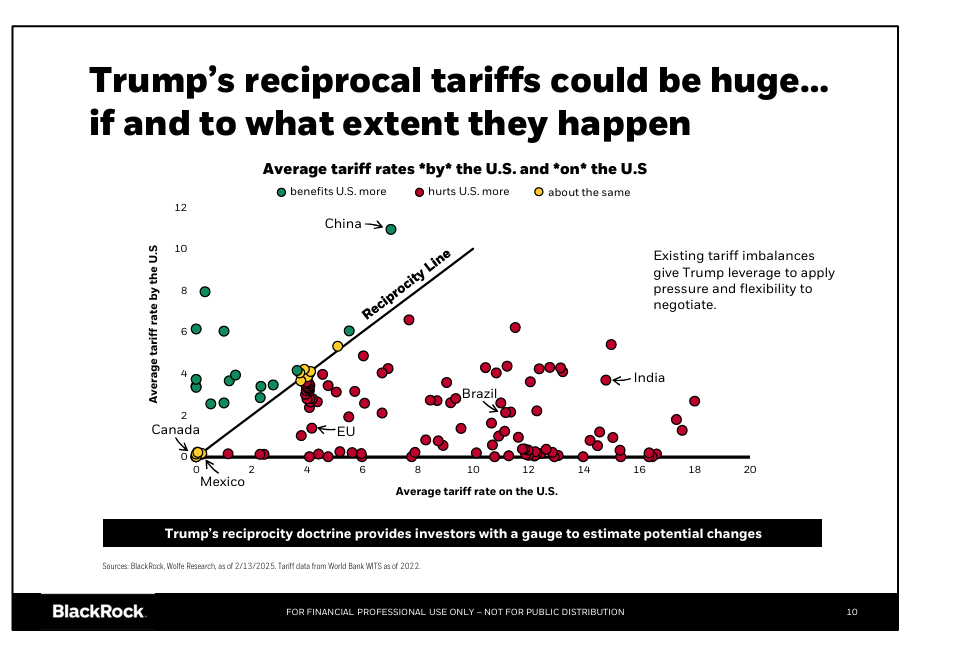

There is daily news on tariffs, what they could look like, and their potential impacts. We field these questions most often lately. So let’s take a look at the details. First of all, a tariff is a tax imposed by a country on imported goods and services whose purpose is typically to influence trading partners, raise revenues, protect competitive advantages, regulate foreign trade, and safeguarding domestic industry.

On February 13th, the president issued a memorandum directing several U.S. agencies to come up with plans for specific tariffs to achieve even footing with other countries. As Trump put it on social media, “Whatever countries charge the United States, we will charge them—no more, no less.”

Blackrock put together the following graph that demonstrates significant dispersion of how these tariffs could occur. It is hard to compare tariffs apples-to-apples, but this analysis from Wolfe Research with data from the WTO incorporates Most Favored Nation rates. Most Favored Nation (MFN) rates refer to the trade tariff rates that one country agrees to apply to goods from another country, typically within the context of international trade agreements.

While the current U.S. tariff landscape presents some major challenges, such as increased costs for certain industries and trade tensions with key global partners, we are cautiously optimistic that the overall outlook for future U.S. investment market performance remains positive.

The resilience of the U.S. economy — coupled with a strong domestic consumer base, innovation-driven sectors, and a flexible labor market — provides a solid foundation for potential continued growth.

Housekeeping items

Promotions and new hires: We are excited to say that Horst & Graben is growing. We have been very fortunate to be surrounded by a great team, and our goal has always been to hire talented people and then move them up to positions of greater responsibility. Claire has been with us for a little over a year and is now moving up to do trading with Elizabeth. We have hired Savannah to take over Claire’s position. Savannah was born and raised in the California Bay Area. In her youth, she had a passion for missions and spent six months in South America, where she assisted with schools and children's programs. She graduated cum laude with a bachelor’s degree in organizational communication from George Fox University. Through her mission work and her previous role in constituent services, she developed a strong desire to serve others. In her new position as Client Relationship Specialist, she is excited to help and welcome all our clients.

Tax forms: All your tax forms should have been populated by now. To view or download your tax forms, log into your Charles Schwab account at https://client.schwab.com/ and navigate to the "Documents" or "Tax Forms" section. There, you should be able to find forms like your 1099s or other tax-related documents. If you're having trouble accessing them or need more specific guidance, please give our office a call and we can assist.

2024 IRA contributions: If you have not filed your taxes yet and are looking to make 2024 contributions to your IRA or Roth IRA, please submit those requests by March 31, 2025, so that Schwab has time to process them. The contribution limit for Roth and Traditional IRAs for 2024 is $7,000 for those under 50 and $8,000 for those 50 and older.

We continue to preach that a good financial plan and asset allocation strategy is the best long-term approach. We know times of volatility and upheaval can be stressful and scary. We appreciate your continued trust and are available to answer any questions you may have.