Market Update, Diversification Insights & Portal Transition

We’re reaching out as we continue to navigate through a period of heightened market volatility and mixed economic headlines. As always, we believe that having a well-diversified portfolio and a thoughtful financial plan helps make these moments more manageable.

Growth Expectations:

Recent data has led to revised-down growth expectations. Concerns around trade policy suggest potential for rising prices and slower economic growth. While the U.S. economy began this period from a position of strength, which may help it avoid a recession, we still anticipate short-term volatility.

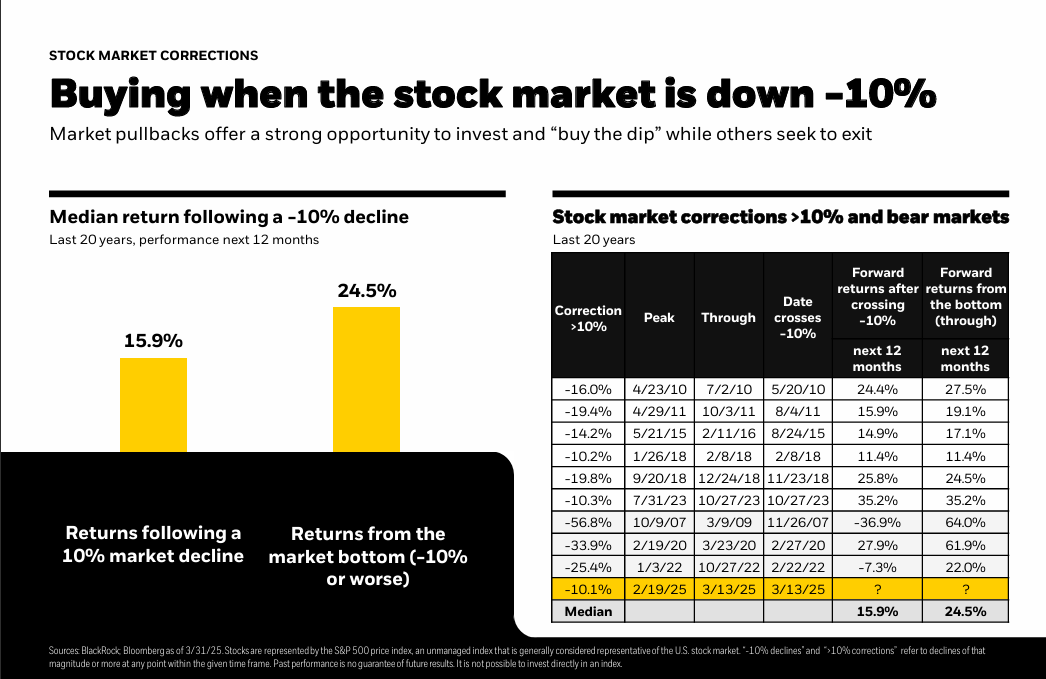

Why Staying Invested Matters:

History consistently shows that remaining invested during volatile periods tends to benefit long-term investors. While short-term fluctuations may continue, the broader outlook remains optimistic. For example, over the past 20 years, a market pullback of 10% or more has led to a median return of approximately 16% in the following 12 months (per our partners at BlackRock).

We have had a great two-year run in the markets. However, at this point we have given up our early of the year gains and are now seeing more volatility.

We moved into 2025 with a decidedly risk-on stance in our portfolios, reflecting an optimistic view of the strength of the overall U.S. economy and a better-than-consensus outlook on the trajectory of corporate earnings. But over the past few months, the markets have been on quite a rollercoaster ride driven by a series of headline-grabbing events. Following the election, there was a surge in market returns as investors welcomed a pro-business agenda, with potential for corporate tax cuts and deregulation. However, this initial excitement has begun to wane.

Blackrock put together this chart showing the markets since the election:

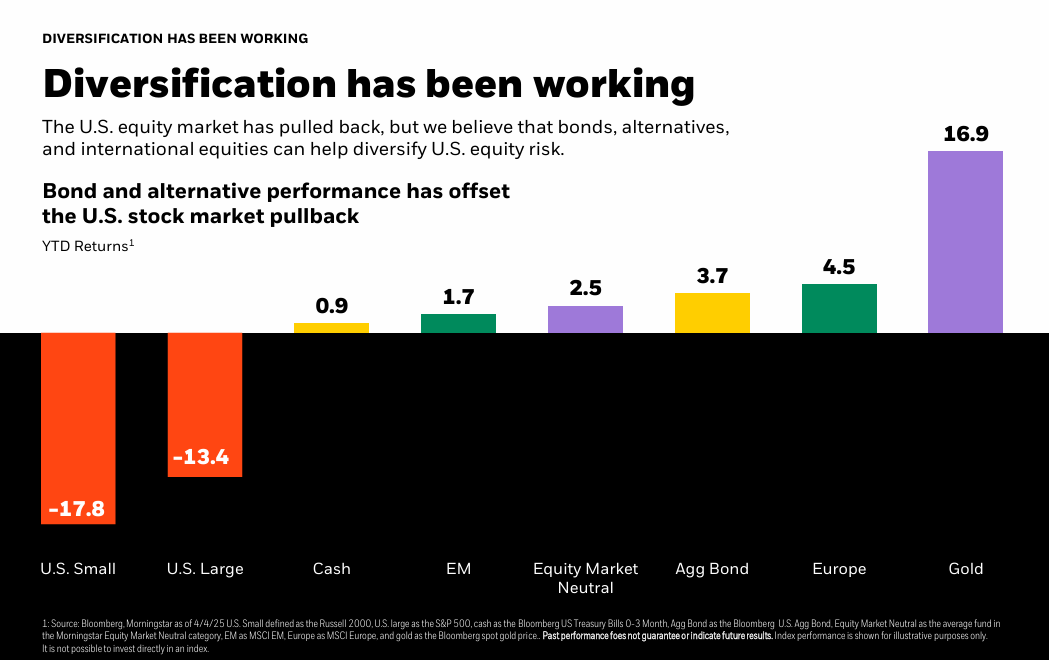

Diversification:

Diversification continues to be a key strength in our approach. Allocations to bonds, gold, and international equities have all helped soften the impact of the market downturn. The accompanying chart (attached/included) shows how various asset classes have performed year-to-date, underscoring the value of a balanced strategy.

Upcoming Portal Transition:

Morningstar will be retiring its client portal by the end of 2025. This platform currently houses your reports and document upload tools. After a careful vendor search, we’re excited to announce we’ll be transitioning to AdvisorEngine, which offers several key improvements in user experience and functionality.

We’re currently in the process of migrating data and testing the new system. This will take a few months, and we’ll keep you updated to ensure a smooth and secure transition.

A Quick Reminder on Fraud Prevention:

Periods of market uncertainty often invite scammers who exploit fear by offering fake investment opportunities or "safe" assets with unrealistic returns. Please remain vigilant. If anything, ever feels off, reach out to us directly. Protecting your information is a top priority, and we’re constantly updating our systems to stay ahead of threats.

We truly appreciate your continued trust and partnership. If you have any questions or simply want to touch base, we’re always available.