Second Quarter Update

As we close out the second quarter, we wanted to touch base and share some thoughts on the markets and recent updates from our team. To say that 2025 has been volatile and filled with uncertainty would be an understatement.

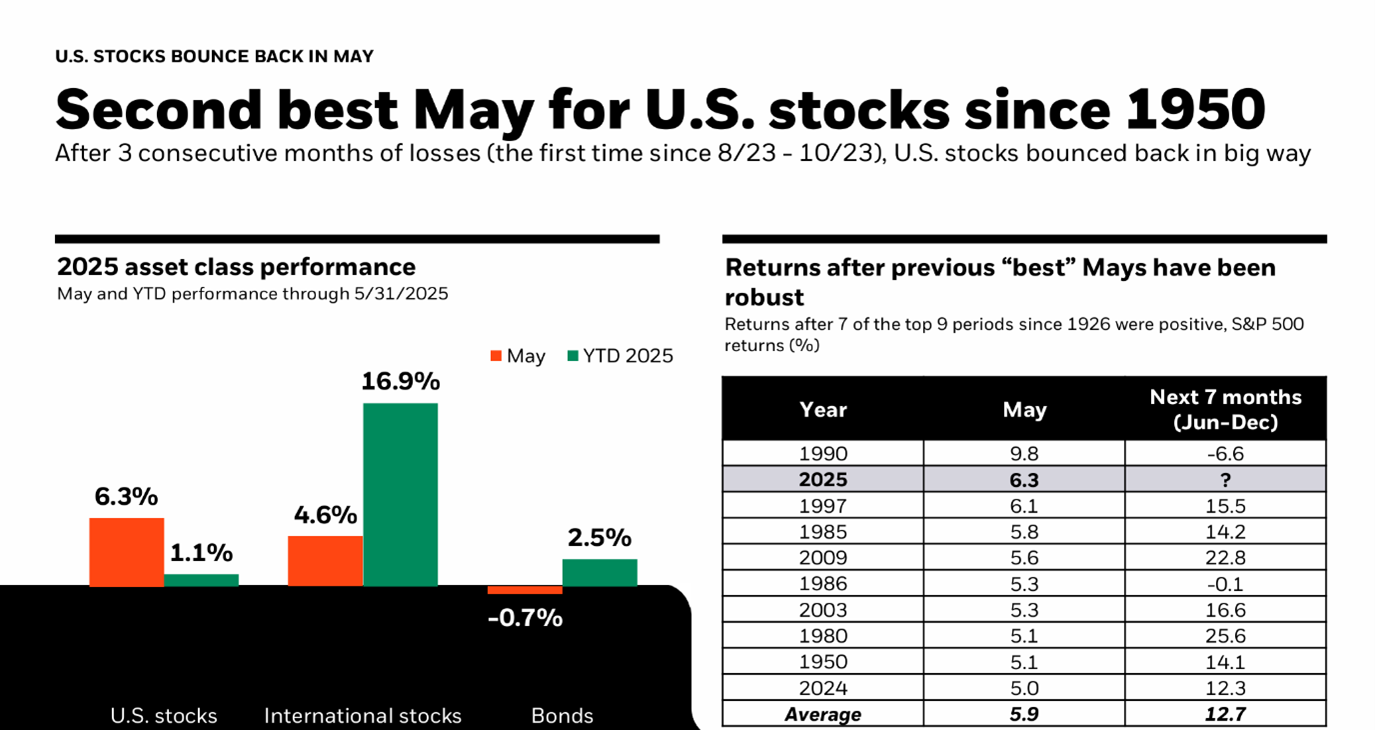

After a sharp sell-off in April, markets rebounded strongly in May—delivering the second-best May returns since 1950. Our partners at BlackRock shared a compelling chart highlighting the historical strength of May, which reinforces the importance of staying invested during periods of turbulence.

May’s rebound was largely driven by easing trade tensions. Updated policy statements brought renewed optimism and pushed valuations higher from their April lows. While this bounce is encouraging, we remain cautiously optimistic. Trade policy continues to evolve, and we expect volatility to persist through July and August as negotiations unfold.

Portfolio Rebalancing

We’ve rebalanced client accounts three times this year:

February – to realign portfolios after the January rally.

April – to bring allocations back into alignment after the sell-off.

Late May – to fine-tune our positioning following the rebound.

In our most recent rebalance, we:

Reduced equity overweight from 3% to 1%, using the rally as an opportunity to recalibrate risk while maintaining a modest pro-growth tilt.

Added to high-conviction U.S. equity positions, including mega-cap and AI-driven companies benefiting from structural tailwinds, and employed active thematic strategies designed to take advantage of ongoing market volatility.

Increased exposure to value-oriented developed market equities, while reducing our underweight to China in emerging markets—aiming to balance regional risks amid ongoing geopolitical uncertainty.

Enhanced portfolio resilience by diversifying into global bonds, short-term inflation hedges, and slightly extending duration in fixed income.

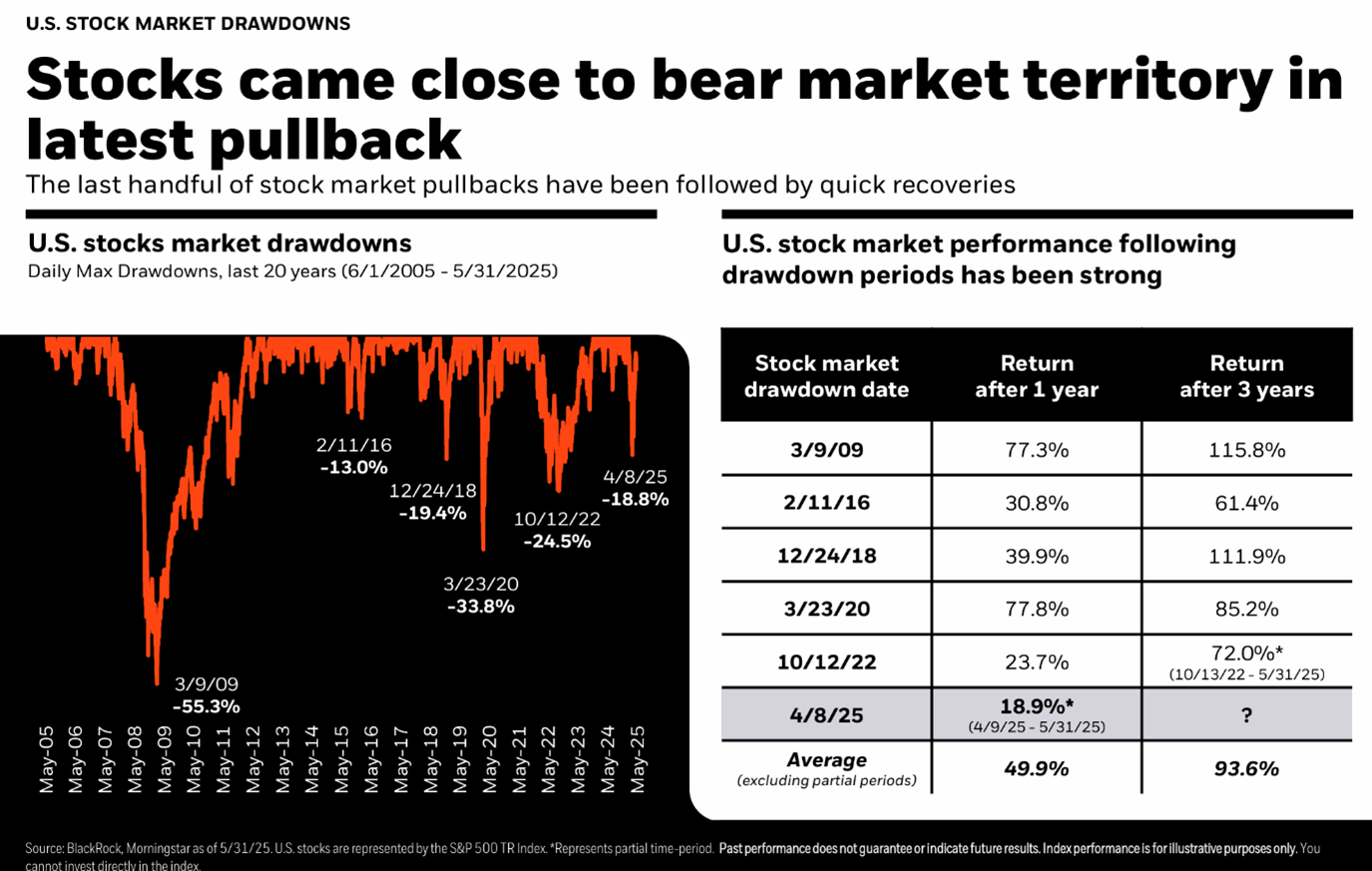

With April’s pullback, we came close to entering bear market territory. As a quick refresher: a correction is typically defined as a 10% drop in the market, while a bear market is a decline of 20% or more. We also found a chart highlighting historical pullbacks and subsequent 12- and 36-month market recoveries, which we found encouraging and insightful.

Horst & Graben Updates

New Billing and Reporting System

As previously mentioned, we’re transitioning to a new billing and reporting platform—moving away from Morningstar Office. We’re confident this change will significantly improve the client experience. Your current Morningstar login remains active for now, but later this fall we’ll begin helping clients transition to the new system, which will offer improved access to your accounts, billing details, and more.

We’re excited about the enhanced capabilities and look forward to sharing them with you.

Welcome to Our Summer Intern

We’re also pleased to introduce our summer intern, Erica Ling. Erica is a Beaverton native and just completed her first year at Purdue University’s Honors College, where she is pursuing a degree in business—likely with a focus in accounting.

She’s already making a great impression, balancing her time with us while also working at Red Tail Golf Course. Erica exemplifies the Horst & Graben work ethic, and we’re grateful to have her on our team this summer. As many of you know, Jamieson credits his own career path to a meaningful internship—so we’re happy to pay it forward.

We hope you and your families continue to enjoy a relaxing and refreshing summer. As always, please don’t hesitate to reach out with any questions or if there’s anything we can do to support you.