Q3 Market Recap & Q4 Planning Opportunites

The third quarter just wrapped up — and it turned out to be a strong one. 2025 has been marked by headline risk, tariffs, trade policy, and geopolitical tensions, but despite the volatility, it’s been a powerful reminder of the importance of staying invested for the long term.

This year has delivered the best nine-month start since 1997. What began, as has become the norm, with the “Magnificent Seven” leading the way, has evolved into a year of broadening participation. We’ve seen solid performance not only in U.S. equities, but also in our gold, international stock, and bond positions.

We also completed a portfolio rebalance a couple of weeks ago.

Key Takeaways

Added 1% to equities to move to a 2% overweight position — modestly increasing market exposure on a friendlier policy backdrop while keeping key portfolio shock absorbers in place.

Increased U.S. exposure relative to developed international markets, maintaining a preference for growth-over-value domestically and value-over-growth abroad.

Expanded AI exposure, focusing on “builders and enablers” — the compute, cloud, and software companies powering the next industrial revolution.

Initiated a new position in global aerospace & security, targeting potential beneficiaries of a multi-year modernization cycle fueled by government spending.

Maintained neutral duration in bonds while adding convertible bonds for equity-like upside in bond-heavy portfolios.

Trade Rationale

Our foot’s back on the pedal — but still far from “full send.” Economic growth signals remain mixed, and the labor market has softened, yet this slowdown has created space for more accommodative monetary policy. Inflation remains around 3%, but as history reminds us, “don’t fight the Fed.” We’re leaning into that tailwind, with our seatbelts fastened, aware that policy and geopolitics can still jolt markets.

Within equities, we continue to view AI as both a growth catalyst and a defensive hedge. Demand for high-performance computing is expected to nearly double annually, and we see generative AI as a durable, multi-decade structural trend — comparable in scope to the dawn of the internet. We expect roughly half a trillion dollars of annual investment to flow into this space, creating new leaders and reshaping industries. Our approach emphasizes active strategies to capture these evolving opportunities while avoiding the broad exposure (and risk) of passive indexing.

Globally, easing in the U.S. often softens the dollar — a positive for emerging markets. This supports our modest EM overweight, and our neutralization of the China underweight, not as a long-term pivot but to reduce uncompensated volatility. Meanwhile, we’ve deepened our underweight to developed international markets, favoring select value-oriented opportunities, particularly European financials, where disciplined capital use, healthy dividends, and supportive rate spreads create attractive risk-reward dynamics.

On the defensive side, lower real rates favor precious metals, so we’re maintaining — and modestly increasing — those positions as a hedge against policy uncertainty and geopolitical risk. Convertible bonds add “upside with airbags,” giving portfolios participation potential with downside protection. And with rising global commitments to defense, cybersecurity, and infrastructure, we’re intentionally investing alongside those long-term trends.

The bottom line: The Fed has given us a green light to be selectively bold. We’re pressing our advantage where opportunities look strong — and staying disciplined where signals remain unclear.

4th Quarter Tax Planning

With the passage of the Big Beautiful Bill, here are a few timely reminders to discuss with your CPA or tax professional before year-end:

SALT Deduction Expansion – For clients in high-tax states such as Oregon and California, the State & Local Tax deduction cap increased to $40,000 for 2025. Review your situation to see if any planning opportunities arise.

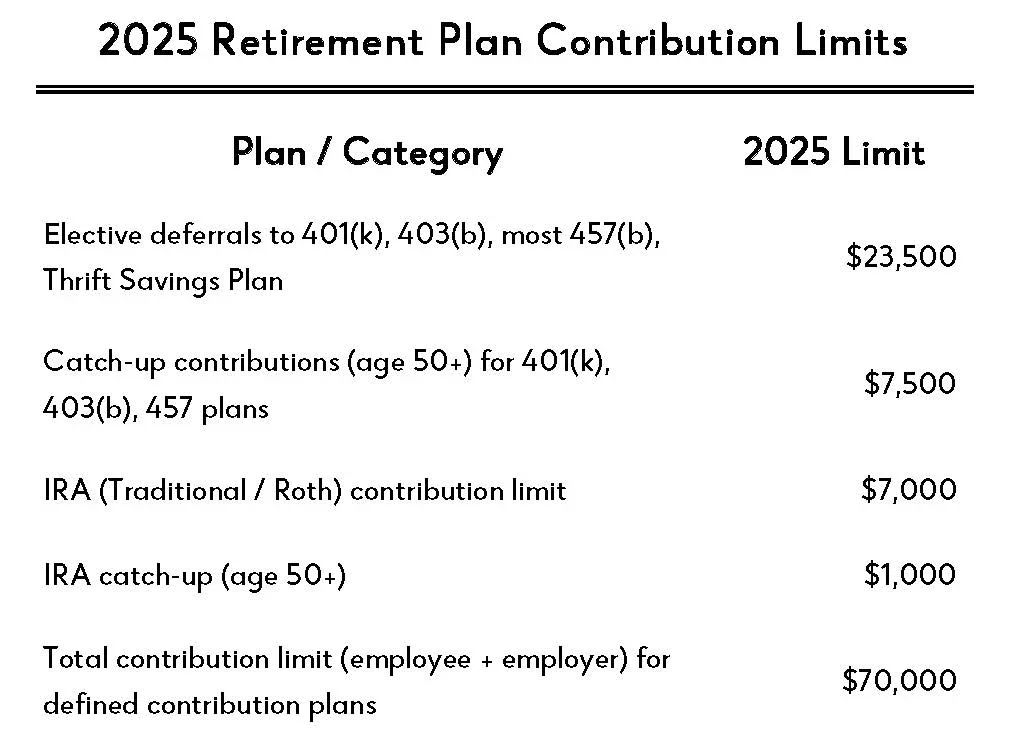

Maximize Retirement Contributions – Now’s a good time to confirm you’re on track to hit maximum contributions for 401(k), IRA, or Roth accounts before year-end.

Charitable Giving Opportunities –

Consider “bunching” charitable donations (combining multiple years’ worth of giving into 2025) to exceed the standard deduction.

Donate appreciated securities to avoid capital gains and still claim a fair-market value deduction (subject to limits).

Use Donor-Advised Funds (DAFs) to take a deduction this year while distributing gifts to charities over time.

Review Withholdings and Estimated Payments –

Mid-to-late year is a good time to check that you’re on track. Adjust withholdings or make additional estimated payments if your income has changed significantly.

If you’re self-employed or have significant non-wage income, ensure you meet IRS “safe harbor” thresholds.

Extra Standard Deduction for Seniors – Beginning in 2025, there’s a temporary $6,000 additional deduction for those age 65+ (available through 2028). It phases out for income above $75,000 (single) or $150,000 (joint). This may create Roth conversion or other planning opportunities.

Business Owner Planning – If you own a business, discuss year-end strategies with your CPA, such as:

Accelerating capital purchases and utilizing Section 179 expensing

Reviewing compensation timing

Exploring business tax credits and deductions

Please find below a graph illustrating the 2025 retirement plan contribution limits across various account types.

Advisor Engine

As previously communicated, Advisor Engine is replacing Morningstar as our new platform for reporting, billing, & accessing quarterly reports. Going forward, you will view your reports directly within your Advisor Engine client portal. Invitations to create your login credentials have been sent. If you need a new invitation, please don’t hesitate to contact our office—we’ll be happy to resend it promptly. Please note that each invitation link is valid for one week, and we are reissuing them on a weekly basis as needed.

We recommend that you bookmark the login page for Advisor Engine https://portal.horstandgraben.com/login. We are excited about Advisor Engine and we appreciate any feedback you may have to offer.