2026 Market Outlook, Tax Updates, & Important Planning Notes

We hope this note finds you and your families doing well. We can’t believe we are already into 2026.

2025 ended up being a strong year from a market performance standpoint. Not only did equities perform well, but we also saw solid returns from both our gold allocation and fixed income positions. Despite ongoing negative headlines and geopolitical events, we remain cautiously optimistic about 2026—while fully expecting increased market volatility. We wanted to touch base on a few key topics.

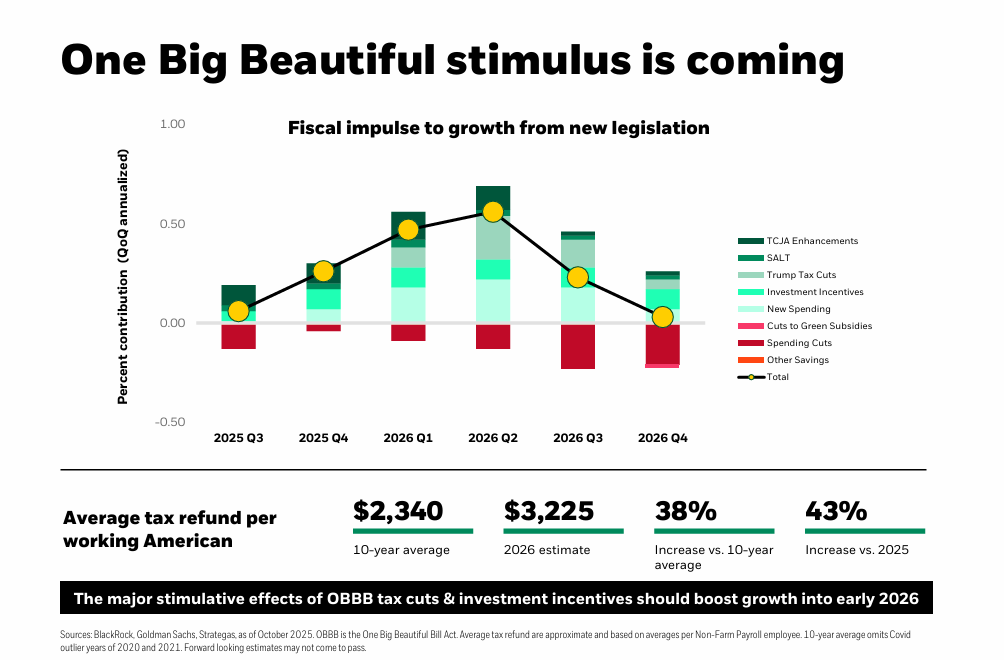

Tax Updates – One Big Beautiful Bill Act

We believe this legislation could provide near-term stimulus—or a “sugar high”—for the economy that may last through 2026. The bill made individual tax cuts permanent, expanded and added new tax deductions (especially for seniors), and increased the SALT deduction cap—benefiting many of our Oregon and California clients, among other provisions. This was passed in July of 2025 but a number of the changes were retroactive to the beginning of 2025.

Our friends at BlackRock put together the chart below illustrating the potential quarterly growth impact from these changes.

AI Trade – Bubble or Not?

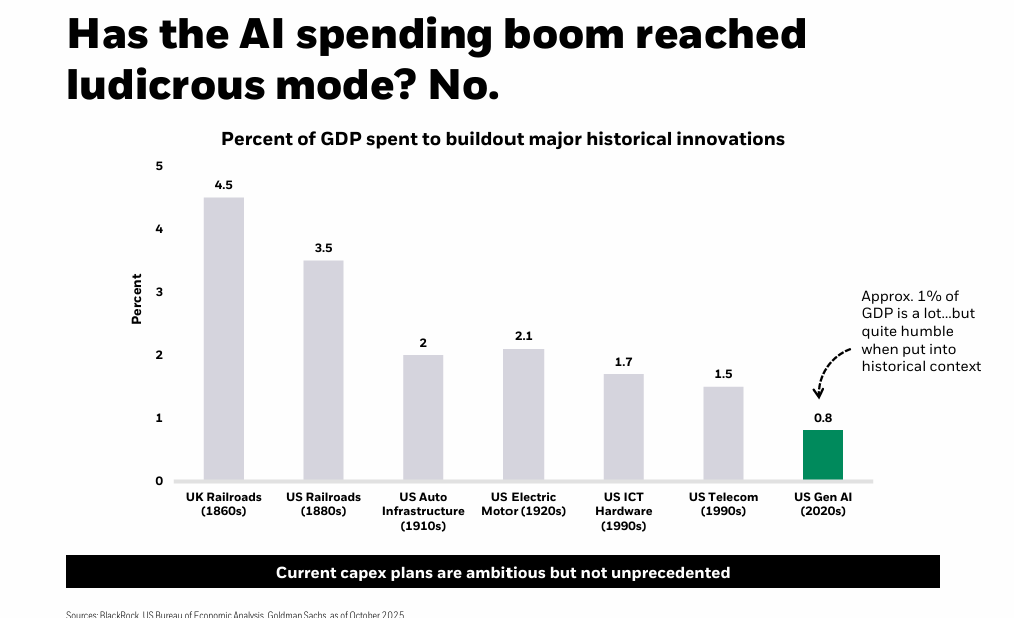

We do not believe we are currently in an AI bubble. Unlike classic bubbles marked by oversupply and idle capacity (such as empty fiber networks in 2000 or vacant housing in 2007), today’s AI cycle is being driven by strong corporate earnings and real underlying demand.

While the scale of investment in AI is extraordinary, this buildout is largely being funded by operating cash flow rather than speculative leverage. Hyperscalers such as Microsoft, Amazon, and Google are generating hundreds of billions of dollars in free cash flow and maintaining net cash positions, allowing them to fund record levels of capital expenditures.

We also found the chart below compelling, comparing today’s AI buildout to historical innovation cycles.

As always, we expect markets to remain volatile and continue to emphasize a long-term perspective. Maintaining a well-diversified portfolio alongside a thoughtful financial plan remains critical. With several potential tailwinds—including tax cuts, moderating inflation, lower interest rates, and continued GDP growth—we remain cautiously optimistic.

2025 Tax Documents

It is that time of year again to begin gathering tax information. Below are important dates related to Charles Schwab tax documents.

Charles Schwab processes tax documents in three production runs each year:

First production run: Expected by January 30. This includes brokerage accounts for which Schwab has received all required tax information. IRA tax documents are typically available during this release.

Second production run: Expected by February 13. This generally includes after-tax brokerage accounts and any remaining IRA accounts.

Final production run: Expected by February 27 and includes any remaining accounts.

If corrections are required, updated tax forms are generally issued within 30 days of the original 1099 posting.

Clients with online access may view the status of their documents and download tax forms through Schwab’s 1099 Dashboard:

https://www.schwab.com/1099dashboard

Please do not hesitate to reach out if you have any questions about your forms or need assistance retrieving them.

Updated Catch-Up Rules for 401(k) Plans (Effective 2026)

We have received several calls and emails regarding catch-up contributions in retirement plans. Please note the following important update:

If you are age 50 or older and your prior-year wages (FICA wages) from the same employer exceed approximately $150,000 (indexed for inflation), any catch-up contributions in 2026 must be made to a Roth 401(k) or 403(b)—meaning after-tax dollars.

We appreciate your continued trust and confidence. Please do not hesitate to reach out with any questions or to discuss how these changes may impact your personal financial plan.