Happy New Year!

We hope that your 2025 has started off well. It seems that no matter what year it is there is always excitement and things to be concerned about in the markets.

2023 and 2024 ended up being great years for the markets, however we started to see some volatility creep into the markets in December. A lot of this was driven off concerns, even though the Fed reduced rates again, that we could see a resurgence in inflation data and the Fed may not cut rates as many times as the markets had expected in 2025. One of the key concerns for the markets is what will Trump’s tariffs look like and what kind of inflation could this cause in the short-term.

We think it is healthy for the markets to have some pullback after big run-ups, however it always creates a bit of anxiety in the short term. While we pay close attention to fires burning in California, national political change, uncertainty in the Middle East, and terrorist attacks in our country to name a few. We try hard to stay out of the headline news and really focus on the economic facts.

We are cautiously optimistic for 2025, and the recent volatility is normal. The underlying economy still looks strong. We continue to see low unemployment for 2025, interest rates moderating a bit (although lots of volatility), and S&P 500 earnings growth estimated at 15% for 2025 which is very healthy.

With the volatility in the bond markets and interest rates we have seen a record amount of money sitting in cash. As of the end of the year there is $6.8 Trillion dollars of cash sitting on the sidelines. We see this as a positive with the possibility we start to see portions of this cash making its way into the markets.

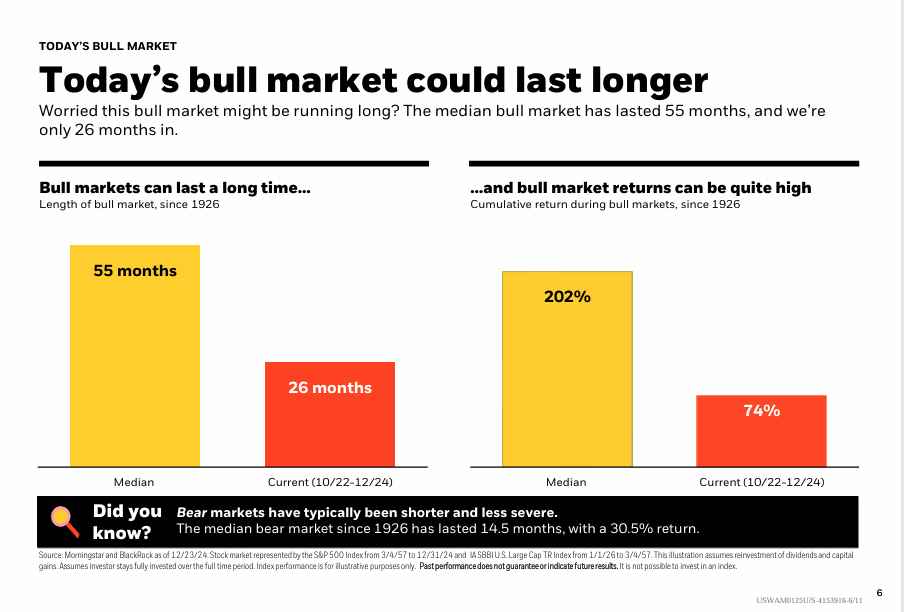

We have been in a bull market for 26 months, however the median bull market has lasted 55 months. Our friends at Blackrock put this interesting slide together looking at this.

As a reminder our crystal balls are on back order, however we feel good about 2025.

Tax Documents:

2024 tax documents will be populated in waves at Charles Schwab. The first wave of processing begins the end of January, the second wave is usually mid-February, and the third wave is by end of February or early March. If you are supposed to receive a tax form, you will be notified by Schwab via email or mail. So please keep that in mind when receiving any mail from Charles Schwab in the early new year, don’t throw it out, because it may be your tax document. If you can’t find what you need or are not sure that you have everything, please do not hesitate to give us a call.

Fraud/Cybercrime alert:

Fraud and cybercrimes are serious threats, and we need to keep being aware and cautious. Some clients have reported getting a text message regarding a movement of funds, and come to find out, this was a fraudulent text message trying to get you to call in and give them your information. Anytime you have questions or suspicions, please contact us and we can confirm any transactions. A reminder that we will always verbally confirm with you before moving money in or out of your Charles Schwab accounts. Schwab also has many protocols and policies to protect your accounts held with them. We continue to update our processes and procedures to ensure we are doing everything we can to protect your information and accounts.

As always, we appreciate your friendship and support. Going into the New Year we are very thankful to work with such great people and we look forward to the future with you.