Our Expertise

Get a sneak peak of what our clients are putting into practice.

Bearing Up in a Bear Market

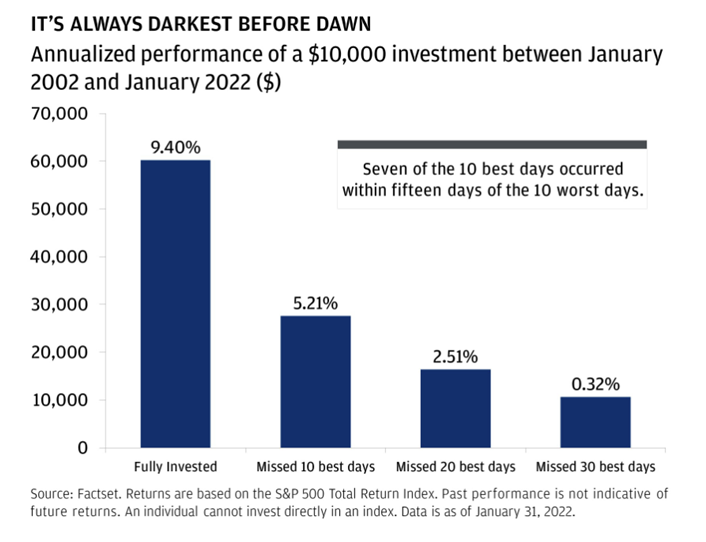

No bones about it: 2022 has been an extremely tough market year, and the latest downturn at the end of the third quarter pushed us into a bear market within the major stock indices. A bear market describes a prolonged drop in stock prices where the indices drop by 20% or more. Our advisors have lived through many different market cycles, from Y2K to the Dot-com bubble, September 11th to the Great Recession, Russia invading Crimea, Brexit, COVID, and the current period of high inflation. We have seen the markets swing from excessive enthusiasm to extreme pessimism. Through each of these periods, Wall Street has encouraged investors to make the decisions of six months ago – buying high and selling low, and staying out of the market as it begins to recover.

Student Debt Relief: Forgiveness is Just One Piece of the Pie

One in seven Americans has student loan debt, and over 90% of that debt is held by the federal government. This made the White House’s recent reforms to its student loans impactful for roughly ten percent of the population. It is important to note that these changes only apply to federal borrowers, and not to privately held loans.

Year-to-Date Market Recap

“The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.” –Seth Klarman

We hope this note finds you and yours doing well. As summer draws to a close and the school year begins, we have been reflecting on a crazy year – from the drawdown of the pandemic to the Russian invasion of Ukraine, stubbornly high inflation to daily political drama, and plenty of stock market volatility into the bargain.

Roth Conversions: An Alternative to Sitting Tight

While history shows us that the best thing we can do during a down market is to sit tight and not make major changes to investments, it’s often easier said than done. As we’ve shared over the past several months, in response to this year’s difficult market performance so far, we’ve made tweaks within our models, primarily to tip toward funds that tend to prove more resilient in times like these. This is an action based around investments, but certain planning opportunities have opened up too. The Roth conversion process we’ll describe below isn’t the best fit for everyone, but if you feel like it fits you and are interested, feel free to reach out to us.

When the Going Gets Tough...

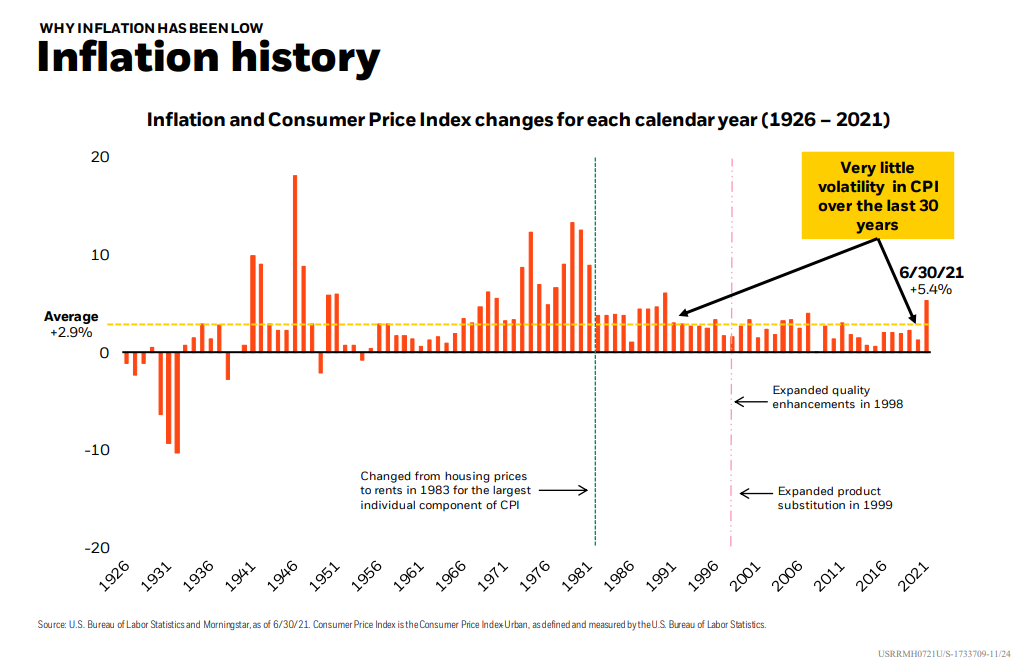

What is causing this volatility? The markets have been shaken this year by a flurry of investor worries. For one thing, inflation is at its highest rate in decades. This has forced the Federal Reserve to kick off a monetary policy tightening campaign, which includes increasing interest rates, and the markets are trying to figure if that’s doable without tipping the country into a recession. On top of these fears, we are dealing with geopolitical factors: strict pandemic lockdowns in China, Russia’s invasion of Ukraine, and ongoing political conflicts within the United States.

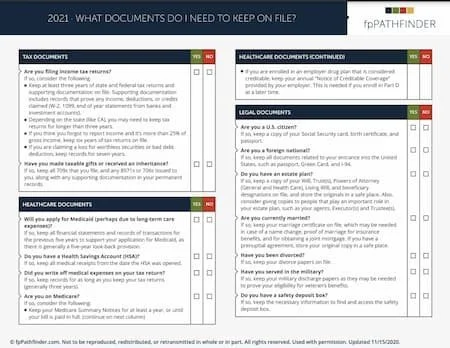

Spring Cleaning Means Shredding

We hope you are looking forward to a well-deserved mental break with the tax filing deadline coming up. Spring cleaning is on the brain – we often get asked by clients, “how far back should I keep my financial documents?” Whether you are inundated by paper files or just want to avoid getting there, let’s walk through some general recommendations.

Keeping Things in Perspective

I know you've been receiving a lot of emails from us over the past couple of weeks, but with the situation in Ukraine growing more volatile, I wanted to reach out with further updates. We typically tweak our investment models on a quarterly basis, but we have made recent changes in response to the ongoing economic impacts of a war in Eastern Europe. In our view, the war itself as well as the sanctions enacted in response could continue to impact the broader European economy, global inflation, and energy prices.

An Economic Update on the Situation in Ukraine

We have received many messages from clients over the past few weeks about the conflict in Ukraine and how it may affect your portfolio. With things unfolding at a rapid pace, we wanted to reach out with the latest information and our recommendations.

Quarterly Update

We have endured so much over the last two years that we wanted to send a shorter letter than usual this quarter to simply say: thank you.

For sticking with us through Zoom meetings. For sticking to the plan when the market looks scary. For sharing your triumphs and losses with us during one of the toughest times the world has ever faced.

We are so grateful that each year since we founded Horst & Graben, over 99% of you have continued to work with us each year.

Quarterly Update

A common topic in our newsletters these past couple of years has been how steady and positive the markets have been over this time. We have cautioned against expecting that to continue into perpetuity, and we saw a chink in the armor this past quarter. Since the first quarter of 2020 and the start of the pandemic, there had not been a single down quarter. Starting in September, we finally saw some volatility. September has consistently been the worst month for US stock returns, historically. From 1926 through 2020, it has been the only month to average negative returns. However, overall, the markets have continued their run-up. The Dow rose from 18,000 to 34,000 over the past year and a half.

Quarterly Update

I hope this letter finds you doing well and staying cool with the recent heatwaves in the Pacific Northwest and around the country. We have just finished the second quarter of 2021, and already this year has had a great start from a return standpoint, much of which is owed to a huge upswing in GDP as the US reopens. In their midyear report, Blackrock shared this chart showing trends in GDP since just before the pandemic, as well as estimates for the next year or so. You can see how early 2020 hits a bottom for all countries, but if you were to take that data point out, the trend line is far smoother, suggesting that the pandemic has served more as an “interruption” than throwing future economic data fully off track.

Quarterly Update

It finally seems like we are in the end stages of the pandemic, so what’s left is to figure out how this will wrap up. How will local restrictions adapt to the downturn in spread that vaccination causes, and how quickly will that happen? When will it be safe for schools to return to 100% in-person teaching, and when will kids be able to get their own vaccinations? The questions that confront us now are so much better than the fearful questions we asked ourselves at this time last year.

Welcome to Patrick Yaghoobians!

We’ve been relieved to see the progress of vaccination steadily increase throughout the US, and particularly in Oregon, as it looks like we may at last be heading for the end of the pandemic. The vaccination rate in the US has reached 2 million doses a day, which only a couple of months ago seemed impossible. Despite the pandemic, we have been busier than ever in service to our clients, and as a result have been on the hunt for a new team member for over a year. That search ended just over a month ago when we recruited a new associate advisor.

Quarterly Update

The second and third quarter were the best quarters for the stock market since 2009, and the significant actions of the CARES Act and the Federal Reserve’s stimulus have helped to keep this performance going. At this point, we believe economic activity is running ahead of expectations in developed countries, but at different paces depending on the virus activity and stimulus packages. We are also starting to see signs of a two-track recovery emerging, wherein some workers, companies, and regions show signs of growing stronger and others are in deep decline.

Happy End of Summer, and a Market Update

We hope our note finds you doing well. As we are now in our sixth month of “COVID craziness,” we thought it would be a good time to reach out. It has been a busy summer at Horst & Graben. Last week, we said goodbye to our two summer interns. Elizabeth is on her way back to Gonzaga and Elaina is on her way back to SMU. We appreciate their efforts and will miss them.

PERS Update

We hope you and yours continue to be healthy as we edge into fall. We want to send particularly good thoughts to our educators, who are working to get up to speed on the plan for this school year alongside the parents of their students!

PERS has provided some information on a couple of the recent changes we discussed in our last newsletter, with additional details to follow.

Happy Fourth, and a Market Update

In advance of quarterly performance reports that will be coming out next week, we wanted to include an update on market performance so far this year. Since the bottom of the US stock market on March 23rd, it has been tempting to either ignore the markets entirely or spend far too much time checking performance. However, the majority of the major indices (like the S&P 500 and the DOW) have mostly recouped their earlier losses.

May Market Update

After a barrage of newsletters in late March and early April, we thought we would give you a reprieve for a little while, but we wanted to touch base again to give you our thoughts on what we are seeing in the markets lately.

PERS Update

While we have been primarily focusing on the impacts of COVID-19 in recent newsletters, we wanted to reach out with some updates, reminders and thoughts about PERS.

Quarterly Update

With the first quarter behind us, we customarily send out a quarterly letter to provide an update on the markets and your portfolios along with our quarterly reports. However, with all of the uncertainty and volatility, we have made it a point to reach out much more often over the past few weeks. With that said, we will give you just a brief update and highlight some notes of positivity we have seen recently.