Happy End of Summer, and a Market Update

We hope our note finds you doing well. As we are now in our sixth month of “COVID craziness,” we thought it would be a good time to reach out. It has been a busy summer at Horst & Graben. Last week, we said goodbye to our two summer interns. Elizabeth is on her way back to Gonzaga and Elaina is on her way back to SMU. We appreciate their efforts and will miss them.

Typically, summer is a time for lots of travel, but obviously the pandemic has changed this. However, several of our team members have been able to do more local travel. Casey and his family were able to spend some time in Bend, and Natalia was able to go on a week camping trip that took her from Central Oregon to Crater Lake and the many stops on the Oregon coast. Megan will be spending a few days at Oceanside in October, and Jamieson and his family spent two nights over Labor Day weekend at Minam River Lodge in Northeastern Oregon. We always knew that we lived in a special state, but with limited travel options, we are getting the chance to be reintroduced to our state’s beauty.

The volatility in the markets this year has been nothing less than breathtaking. As we discussed in previous newsletters, the COVID-19 contraction in the economy has been larger than the Great Recession of 2008-09, however we still believe that the cumulative impact on the economy will likely be less as long as the policy response remains strong enough to the cushion the blow. During this period, we do not believe that the normal business cycle of expansion then recession applies, so we are tracking three major areas:

How successful economies are at restarting activity while controlling the virus spread.

Whether government stimulus is still sufficient and reaching households and businesses.

Whether any signs of financial vulnerabilities or permanent loss of productive capacity are emerging.

Our sense is that March 23rd has a high probability of being the lowest point in the stock market. We have seen the markets rebound dramatically from that point, and we commented in our last newsletter on the big disparity between economic indicators and stock market performance. With that said, said there are still lots of risks and unknowns out there. There remains the possibility of a second bigger wave of cases in the fall as flu season starts, and state and local governments may shut down the economy in response, which could trigger some more volatility in the stock market.

Even though our sense is that we may have seen the bottom, we still expect a healthy dose of volatility as we move forward. With the run-up from March 23rd through now, it would not be a shock or uncommon to see some profit taking in the near term and the markets to move back a bit, as we have seen to some degree yesterday and today.

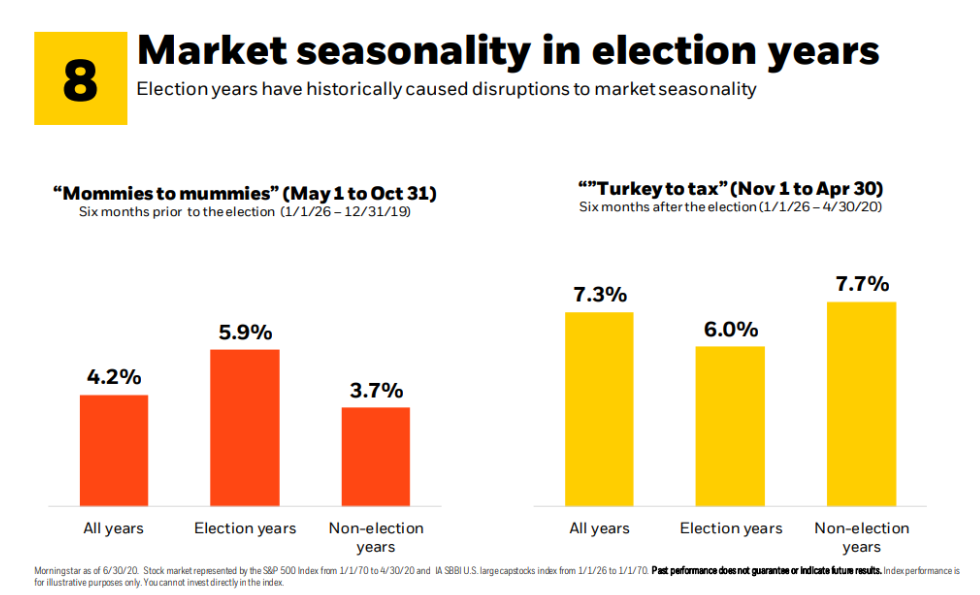

The biggest question we have been getting recently is, how will the election impact the markets? Our sense, strictly from a stock market standpoint, is that the market typically does not care who the President is, it just wants to know who it is. We continue to recommend staying invested in a diverse asset allocation model that fits your overall financial plan and risk tolerance. Our friends at Blackrock put together some great commentary on election year facts for us to share.