Following the Economy and Markets During Coronavirus

Of all the situations that can trigger a crisis in the market, few are as personal as this one. The past month has felt much longer, and the day-to-day volatility we have experienced has been erratic and nerve-wracking, and perhaps reflects the uncertainty we feel in our own lives, as most of us are now experiencing widespread changes to our daily routines and concern for the health of our loved ones. Our economy is threatened by the prospect of a prolonged slowdown in manufacturing and consumption due to the social distancing required to combat the coronavirus, as well as a strong impact on transportation, dining, and “luxury” goods. Our lack of specific knowledge of how long it will last and how deeply it will hit has caused the markets to act on a worst-case scenario.

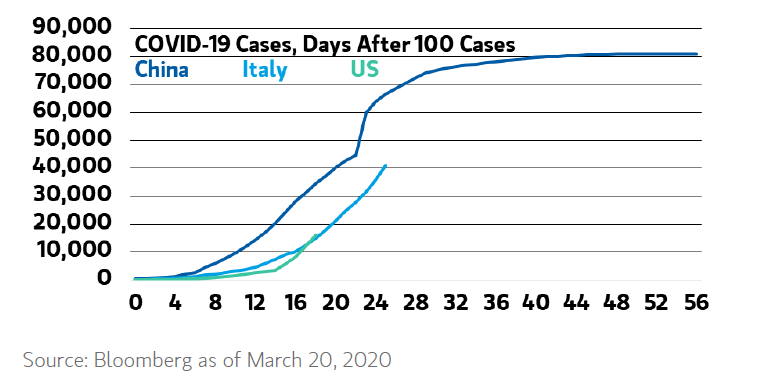

In the face of this, the spread and control of COVID-19 will determine how long the markets and the economy are affected, and so we are endeavoring to stay on top of each nation’s “curve.” China has made remarkable strides in clamping down on new cases, aided in part by forceful social distancing requirements, while Italy’s spike in deaths and continued skyrocketing of new cases makes it a worst-case scenario. The next twenty days will determine whether the US follows the China curve or the Italy curve, and will answer the question of whether the nation can return to business as usual by early summer. China has already returned 85-90% of the workforce, while Italy is expected to remain mostly shut down for several months. The chart below, courtesy of Bloomberg, shows how far along the curve each nation is thus far.

Government action will play an important role in stabilizing the stock market and the economy, both in the US and in each nation faced with the impact of coronavirus.

In the US, two main approaches are available to combat the effects of the coronavirus on the economy, and both have been deployed. Ultimately, we believe this approach of “whatever it takes” policy will help to calm investors and steady the negative effect on the economy. The first is monetary: the Federal Reserve has taken similar actions to ones it took during the 2008-09 recession, lowering the fed funds rate to zero and purchasing long-term treasury bonds. These provide incentives for banks to lower interest rates to consumers on things like mortgages and credit cards, and encourage them to increase their overall lending.

The second is fiscal, and requires bills passed through Congress. So far, a bill extending unemployment benefits, requiring school lunches to remain available despite closures, and making COVID-19 testing free has been passed. Other bills being considered include small business loan programs, giving funds directly to households, and targeted bailouts for the hard-hit airline and energy industries.

So as investors, what do we do at this point? Today, assuming you are in an appropriate allocation, we are recommending that we continue to stay the course. We have had many conversations with our clients over the last few weeks, and we understand the fatigue that comes with markets like this that last longer than a few days. This is absolutely a natural reaction. Markets are influenced by fear and greed, and at this point fear is winning. However, plenty of past market pullbacks show why timing the markets is a difficult bet that usually doesn’t pay off. Selling to cash now, and losing the ability to ride the markets back up over time, could have tough long-term effects on your retirement.

Lastly, some housekeeping news: in compliance with the governor’s Shelter in Place order, we have transitioned to a fully remote work environment. While our team is now working from home, we will continue to check mail on a regular basis at the office. All our contact information will remain the same, including our phone number, and things should feel like “business as usual” other than the lack of in-person meetings.

We wish you and your loved ones a safe and healthy rest of the month, and we look forward to communicating with you regularly during this troubling time.