An Update on Our Office, the Markets, and Coronavirus

We hope our note finds you doing well. We wanted to follow up with you after our last letter regarding the coronavirus outbreak.

We know this is a nerve-wracking and unsettling time as an investor, but first and foremost we are reaching out to share new guidelines for our business that will protect your health and our team's health.

We are instituting new office policies to align with recommendations from the CDC and Oregon Health Authority to support the well-being of our communities. At this time, we are comfortable with continuing in-person meetings as long as you are. However, if you would rather do a phone meeting or a video conference appointment, we are set up to do these. Please let us know your preference when scheduling or confirming an appointment. Casey and Jamieson will continue to be in the office but the rest of our team will be working remotely.

One of the big changes we instituted when we started Horst & Graben was to upgrade our tech capabilities. As a result, despite our remote work we will continue to be available via phone at (503) 342-8900, we will still be available via e-mail, and we will still have our postal mail checked every day. It will be business as usual for our clients, except Casey and Jamieson will be a little lonely at the office.

We believe it is our responsibility during this time to prioritize the health and safety of our clients, employees, and business partners, and contribute to our shared efforts to combat the spread of COVID-19. As we continue to monitor the situation, we will share any changes to our action plan.

Now, onto the market. At a time like this, with double or even triple doses of concerning news daily, a little perspective can go a long way.

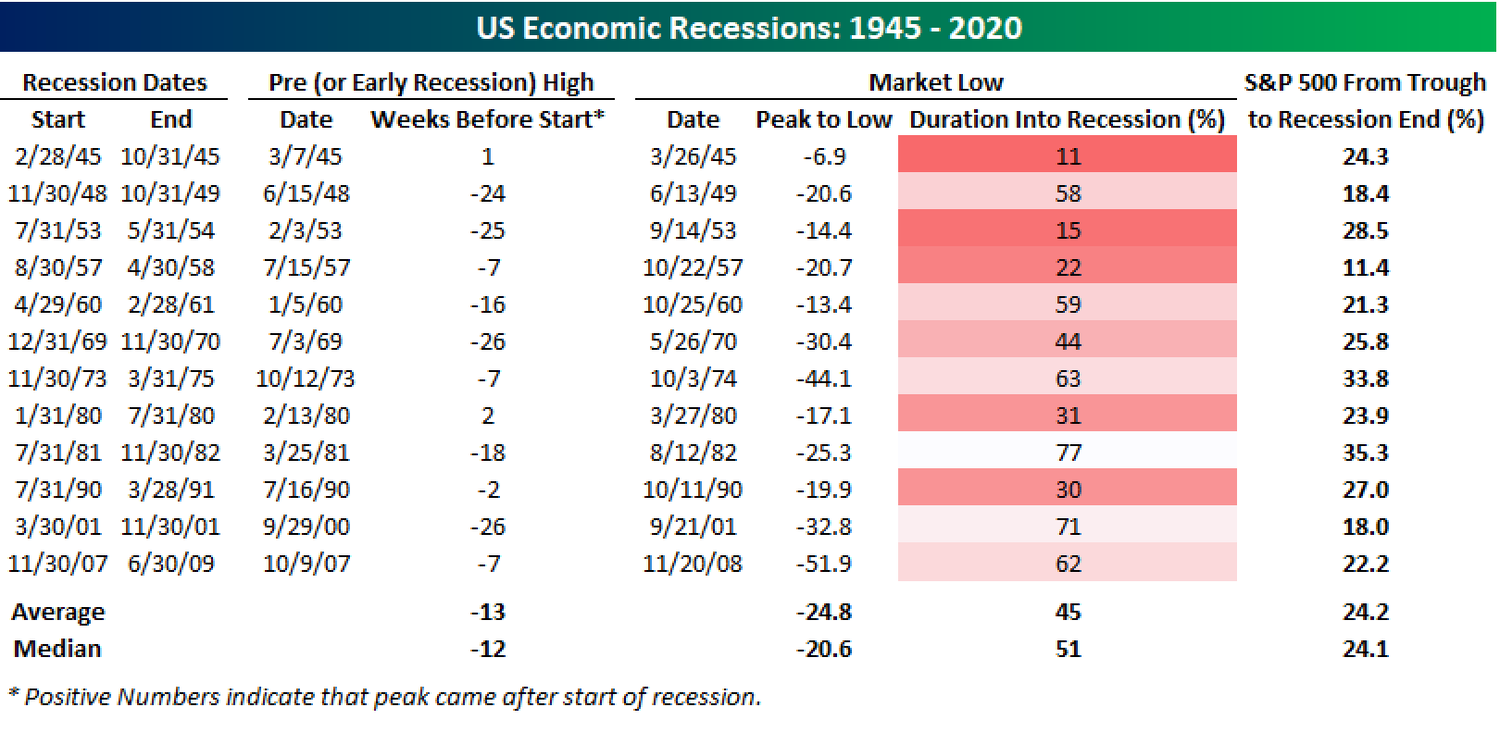

We are now in an official bear market, which is when the markets drop 20% or more. The big question is, will this create a recession? Most analysts think it will at this point. Obviously, we have no idea on how deep or long the contraction will be, or even if we will meet the technical definition of a recession. However, we can look back at prior market downturns as a guide for how the S&P 500 has traded leading up to and during prior recessions. Our friends at Bespoke provided us this chart showing how much the S&P 500 fell from the peak to the low point during these periods. The average drop during these periods was 24.8%, and as of our typing the S&P 500 is down 28.3% from its peak.

What we are going through in the markets is a re-pricing of stocks based on future cash flows (future earnings, dividends, and stock buybacks). The process looks like an erratic and emotional behavior, which perhaps it is. In many ways this feels like uncharted territory, but each past crisis has felt like this in its own way. Even with the headwind and the negative news, we remain optimistic about the prospects for economic and market recovery. The last global recession, the global financial crisis of 2008 and 2009, was deep and long. We don’t view our latest challenge in the same light. The global financial crisis was a house of cards falling down, a crisis of excessive leverage, with the financial system itself in jeopardy. The system is sounder now. And although we expect that global economies will contract in the 2nd quarter, we believe that most will be in a position to rebound strongly later this year and early next year when the virus-related shock subsides and pent-up demand emerges.

We have already seen global policymakers start to respond from central banks all over the globe. We think bold and targeted fiscal stimulus can help individuals and economies get beyond what should be a temporary setback. As long as our asset allocation is appropriate and we have a long-term plan, we continue to believe the best course of action is to ride this through. Uncertainty is a constant and downturns happen frequently, but market setbacks have typically been followed by recoveries.

Downturns may be unsettling, but history shows stocks have recovered and delivered short-term gains. It is very tempting to try to sell out of stocks to avoid downturns, but it is extremely tough to time it right. Our friends at Fidelity put together this chart that shows periods following major downturns that we found helpful. Some of the best times to buy stocks have been when things seemed the worst. Consistent investing can give you the discipline to buy stocks when they are at their cheapest.

Past performance is no guarantee of future results. Sources: Ibbotson, Factset, FMRCo, Asset Allocation Research Team as of January 1, 2019. U.S. stock market returns represented by total return of S&P 500® Index. It is not possible to invest in an index. First three dates determined by best 5-year market return subsequent to the month shown.

In regards to the coronavirus, we think the key to the outbreak is what professionals have called “flattening the curve.” Siobhan Roberts of the New York Times looked at the Spanish Flu that started in the US in 1918, comparing responses from two cities: “Officials in Philadelphia simply encouraged their citizens to try to remain healthy, but otherwise didn’t cancel any public events, including a major parade. By contrast, St. Louis put the city on high alert, and proactively closed schools, shuttered movie theaters, and banned all public gatherings. The end result was that, in Philadephia, the flu spread very quickly, infecting so many people at once that the hospitals were overwhelmed, and a significant number of people died simply because they couldn’t access the limited supply of medical professionals, while St Louis's efforts to flatten the curve of how quickly the disease spread meant their medical professionals didn’t get overwhelmed as the disease played out slowly.” As a result of instituting policies that promoted isolation, St. Louis was able to lower its mortality rate relative to Philadelphia.

On a positive economic note, a number of Asia-Pacific countries appear to already have seen and survived the worst impact of the COVID-19 virus’s growth. COVID-19 originated in China, and that country still holds the vast majority of global cases. But it is also leading in terms of recoveries, and as of March 10th more than 70% of confirmed cases had recovered and been released from the hospital. In smaller city-states like Hong Kong and Singapore, the growth of the virus was never as dramatic, and a range of containment measures seem to have prevented a major burden while keeping transmission rates low. We also note that the death rate in Singapore is zero, and half of its total cases have already recovered. Finally, South Korea and Japan have seen large outbreaks, but recent testing has suggested slower new case growths in the low-single digit range. In South Korea, death rates have been similarly low to Singapore, thought notably these much larger clusters (especially in South Korea) are still not fully contained and recoveries are much lower than the other three countries. Despite the different progressions of these various countries, the theme we are highlighting is one of recovery. As this outbreak has spread from China, to Europe, to the US, it is only a matter of time before we flatten the curve.

We understand how scary this period is and are continuing to monitor this on a day to day basis. Please do not hesitate to reach out with any questions you may have.