Q3 Newsletter

We hope our note finds you and your families doing well at this busy time of year. We have heard from many of you who are attending graduations and end-of-school events, and watching your kids receive college acceptances and start first jobs. Several of you have told us about the great trips you have planned this summer. We are very grateful to have such an engaged client base and to get to watch all these successes.

It’s official: We have a new office!

We officially moved into our new digs last week and couldn’t be happier. As with so many things in life, it took longer than we expected and cost more than we hoped. But we have prevailed and are already planning an open house in September. Look for your invites later this summer.

Please note our new address:

Horst& Graben Wealth Management

6600 SW 92nd Ave., Suite 210

Portland, OR 97223

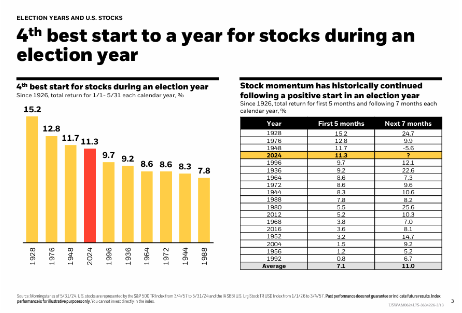

2024 is off to a strong start

We last touched base in April after a strong first quarter for the markets. April started off with a thud, but then we saw markets start to push up and continue on that path. Through the end of May, we had the fourth-best start to a year for stocks during an election year. Our friends at Blackrock provided this great graph illustrating the good start to the year:

The bond market suffers but we have high hopes

The bond market is a different story: It has continued to struggle with all the interest rate movement and uncertainty, ending May as the eighth-worst start to a year for bonds. The real volatility in the bond market started in 2022 with the Fed raising interest rates. Bonds are in a better position than they were in October of 2022, but unlike the stock market have not yet regained their losses.

Blackrock put together this graph showing the worst starts to the bond market and what returns looked like in the second part of those years:

However, we think bonds have great potential over the next couple years, especially when the Fed starts to lower interest rates. We are seeing promising inflation data, and the probabilities of a Fed rate cut this year have increased. With higher yields and potential of rate cuts, we are excited about the bond market’s outlook.

We have rebalanced again

You may have noticed some recent trades in your accounts, as we recently rebalanced most of our clients accounts. For the most part, the facts haven’t changed since our last rebalance, so neither have our minds (or our forecasts). Simply put: stocks over bonds, US over international, mega-cap over small-cap, growth over value.

Here are brief points on the trades we made.

We incrementally increased our exposure to equities in alignment with our view that growth over value is the most effective approach right now. We ran a number of risk with various ratios of stocks and bonds, settling on an appropriate balance of each specific client portfolio.

Our rebalancing added more growth names to amplify exposure to companies that we believe have a chance to exceed their earnings expectations.

We closed out our short position in emerging markets stocks.

We continued to increase our credit quality within our bond mix. We are trying to target resilient investment-grade corporate issues with healthy balance sheets and attractive valuations.

We appreciate you very much! Have a wonderful summer and please don’t hesitate to reach out with any questions or needs.